It’s Not All About Emissions

The U.S. Securities and Exchange Commission (SEC) announced its proposed rules for Climate Change Disclosure this week which will require publicly traded companies to annually disclose how their businesses are assessing, measuring, and managing climate-related risks.

While the rule is only “proposed” at this phase, with public comment open for the next 60 days, companies need to take note of what’s coming. It’s expected that regardless of what happens in the rule-making process, investors will now use the proposed rules to guide how they think about climate risks.

The proposed rule will set a standard that energy and finance companies can’t ignore.

What’s in the SEC’s Proposed Rules?

The SEC’s proposed rules aim to help the investment community understand a company’s potential exposures to climate-related risks. To this end, they would require companies to disclose how they identify, measure, and manage two types of climate-related risks:

Climate Transition Risk

Climate transition risk is business-related risk associated with societal and economic shifts toward a low-carbon future.

External pressures and internal commitments to quickly curb greenhouse gas emissions pose significant risks to many sectors, including energy. Transition risks can manifest as policy and legal risks, market risks, reputational risks, or technological risks that erode business value. To meet mounting stakeholder and shareholder demands, companies across the globe are scrambling to find ways to reduce their emissions without compromising financial performance.

Climate Physical Risk

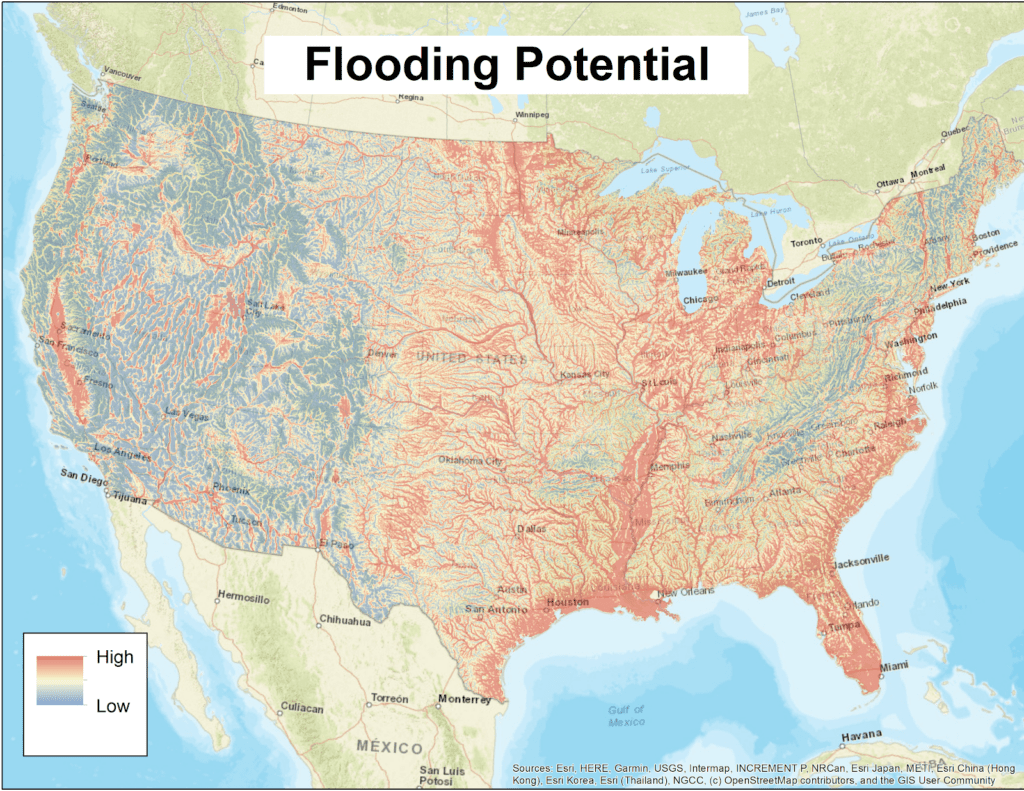

Climate physical risk is business-related risk posed by long-term shifts in climate patterns and acute events such as floods, heavy precipitation, and wildfires. Physical risks refer to damages to physical assets, natural capital, and human lives that hinder business operations and financial performance.

Are climate physical risks really a problem? Yes. Looking at just $2.2 trillion of exposure for syndicated loans, the climate value-at-risk to 28 of the largest U.S. banks from physical risk could amount to more than $250 billion. After financial services, oil and gas is the sector most exposed to direct climate impacts. (Source: Ceres Financing a Net Zero Economy)

There is a lot of money at stake – as well as safety, infrastructure, and environmental impacts that play out before our eyes during every severe weather event.

What Can Energy Companies Do?

Energy companies need to focus on identifying, prioritizing and monitoring the environmental and climate-related risks surrounding their infrastructure. While much of the industry’s attention has been on asset integrity management, Teren has focused on helping companies assess, measure, and manage environmental threats — now a central priority of the investment community.

The physical risks posed by climate change can be either mitigated or exacerbated by site-specific geologic, vegetation, and hydrologic conditions. It’s our recommendation that energy companies implement a three-part approach to mitigate climate-related physical risk and comply with the proposed SEC rules.

1. Assess Your System for Climate Risk and Opportunity

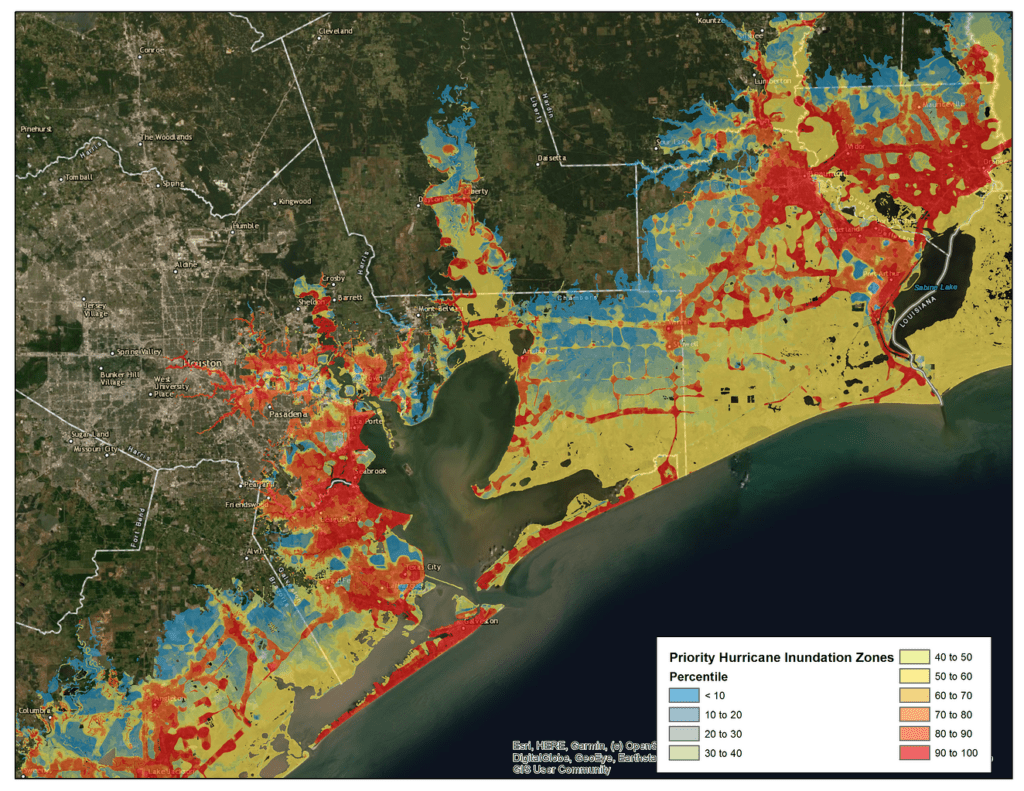

Conduct an assessment of your system to pinpoint areas of highest risk and prioritize mitigation efforts. Whether you’re managing pipelines in Appalachia, electric transmission in California, or solar sites in the Gulf Coast, assess your potential exposures by evaluating subsidence, landslide, inundation, and wildfire threats surrounding your asset.

With a holistic view of your asset, you can identify areas of high risk, prioritize your mitigative investments, and show due diligence in evaluating all potential elements of climate risk.

2. Measure and Predict the Impact of Climate-Related Risk

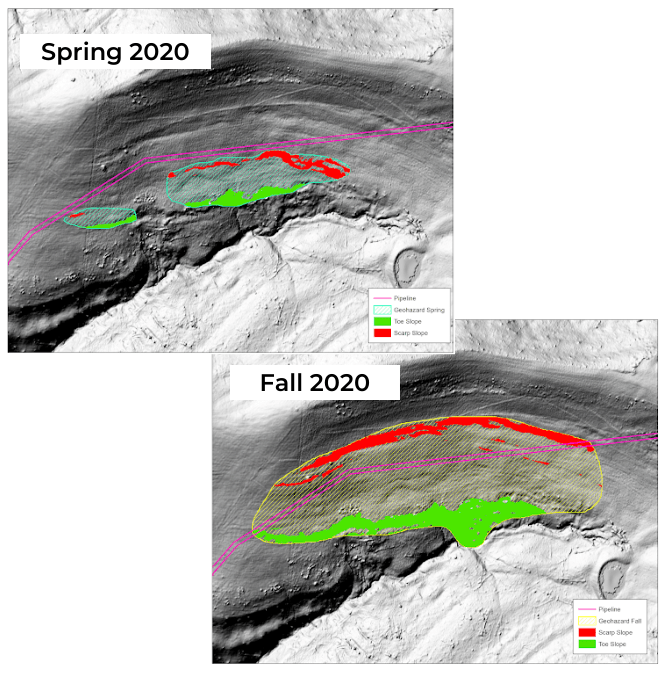

With the highest-risk zones identified, companies should then invest in high-fidelity measurement and monitoring of site-specific threats. With LiDAR-based topographic, hydrologic, and vegetative analysis, companies can identify where physical assets, natural capital, or human lives are most susceptible to the impacts of floods, heavy precipitation, and fires, as well as secondary threats like erosion, landslides, and debris flows that result from climate-induced events.

Regularly assessing the highest risks and monitoring changes over time can not only reduce the likelihood of a catastrophic event, but will support compliance with proposed SEC requirements for assessing, measuring, and managing climate risks now and in the future.

3.Create a Plan for Extreme Weather Events

Even the best environmental monitoring system is at the mercy of severe and unpredictable weather patterns that have become more and more commonplace. While companies can’t control mother nature, we can certainly have a plan in place to assess and remediate damage as quickly as possible.

Energy companies should have a documented strategy to assess an area after a severe storm. In the pipeline sector, current and draft legislation requires operators to evaluate an area with 72 hours of severe weather. The logistics of sending field crews to inspect the conditions of a potentially compromised site is not a viable option given the tight turnaround, and it unnecessarily places personnel at risk.

With fixed-wing LiDAR, companies can deploy field data collection immediately after a significant weather event and avoid sending crews into potentially dangerous territory. With proper machine computing, analyses can be completed and delivered within days, so companies can prioritize and execute mitigation efforts as soon as possible.

What’s the Next Step?

Over the next 60 days, let your voice be heard by the SEC through the public comment process. Be sure to review the proposed rules and submit your comments for consideration.

Then, start putting together your physical risk strategy with the elements outlined above. If you need help with developing a comprehensive strategy, contact Teren to learn more about our approach and how we can help.